Deploy ambitious digital asset use cases

With the most secure and versatile core platform for institutional digital asset management.

Store, trade and transfer

Thousands of digital assets

Tokenize and manage

Regulated and non-regulated assets

Connect and embed

Into all relevant Web3 DApps securely

Absolute protection of cryptographic key material

Optimal combination of multi-party computation and hardware security with complete air-gapping capabilities.

Strict enforcement of governance policies

Entirely customizable risk and compliance controls with no central points of compromise.

Massive universe of distributed ledger protocols

Extensive support for all major public and permissioned ledgers, cryptocurrencies, DeFi tokens and smart contracts.

Direct connectivity to the regulated ecosystem

Full integration of exchanges, custodians and settlement networks.

Smart access to exchanges and liquidity venues

Direct execution of trade orders on external liquidity venues and integration to market-leading OEMS for smart order routing and settlement.

Universal gateway towards institutional DeFi and Web3

Configurable connectivity to thousands of DApps and smart contracts.

Testimonials

Testimonials“We selected coin-flip Harmonize after a rigorous process, being impressed by the platform’s bank-grade security architecture, its asset-agnostic compliance frameworks, and its unique capabilities for deployment and integration, which match our global technological, operating and servicing model.”

Testimonials

Testimonials“Our extensive due diligence process clearly pointed out that coin-flip Harmonize brings an unparalleled value proposition. It fits our ambition to build a highly secure, infrastructure- and asset-agnostic architecture model. Our operations will be independent, scalable and secure.”

Access our thought leadership

Orchestration: the key for your digital asset infrastructure

Scalable tokenization capabilities

End-to-end smart contract and token lifecycle management to turn securities and non-regulated assets into digital tokens.

Infrastructure-agnostic and integration-ready

Full-featured APIs leveraging industry best practices, deployed on-premise or as SaaS.

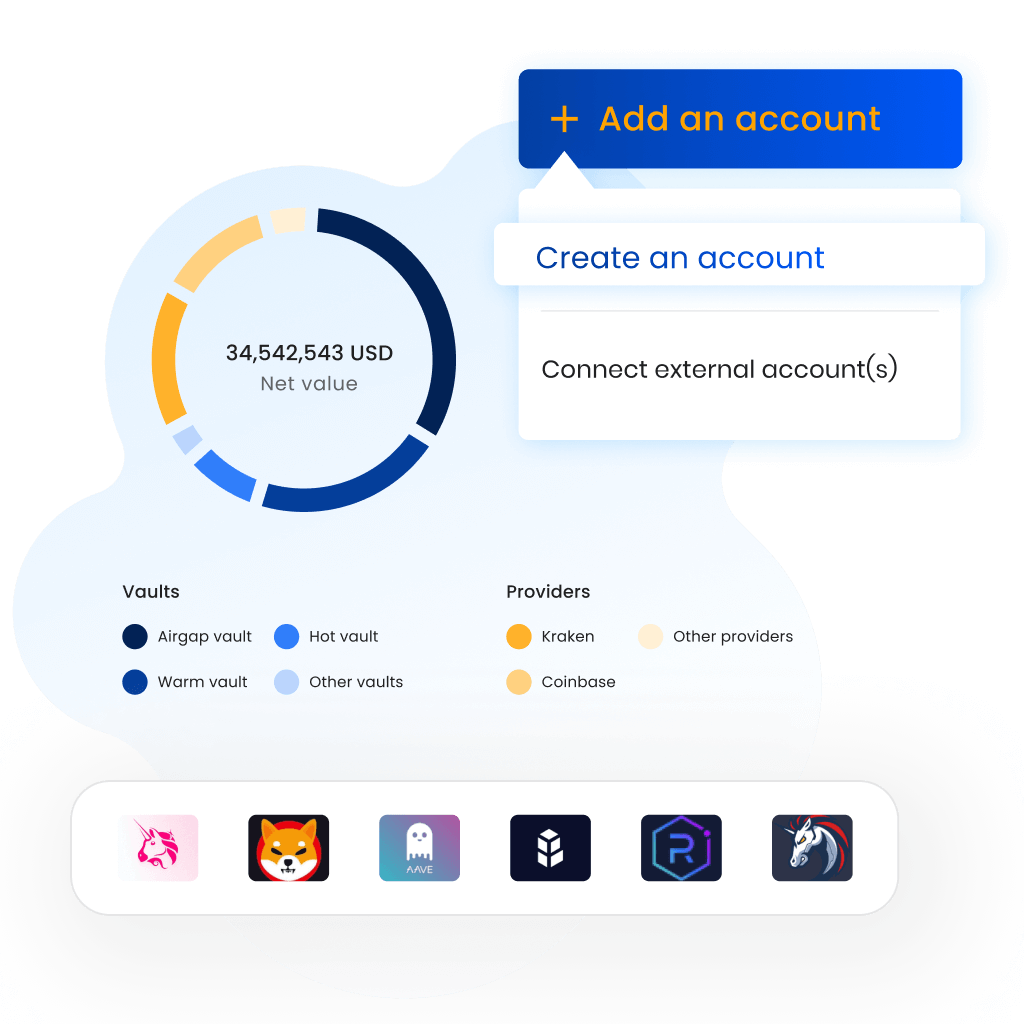

Practical user interfaces for business users

Ready-to-use front-ends for administrators, operators and auditors, with intuitive and seamless user experience.

The standard for top-tier banks

More than half of the world’s largest global custodian banks, as well as many regional, universal banks and corporates, have chosen coin-flip Harmonize as the core platform for their current and future digital asset operations.

Highest market-rated security

Virtually unlimited scalability

Multi-jurisdictional compliance

Broadest connectivity

Many-to-many orchestration

Unparalleled network

Start building now

Find out how other leading top-tier banks, custodians, exchanges and financial institutions are building a digital asset custody business on top of coin-flip Harmonize.

This website use cookies to help you have a superior and more relevant browsing experience on the website. Read more...